Business Growth Through Tendering!

For ambitious UK businesses looking to scale beyond their current client base, tendering represents a key path to sustainable growth! Tendering offers structured opportunities to win substantial contracts with established organisations. The numbers are pretty compelling - the UK public sector alone spends over £300 billion annually through competitive procurement, whilst private sector tendering adds billions more to the mix.

Yet many businesses that could excel at delivering large contracts remain locked out of this market, trapped in what we call the "chicken and egg" challenge. You need proven experience from similar contracts to win bigger opportunities, but you need those bigger opportunities to gain the experience in the first place. This guide breaks down exactly how to overcome this barrier and build a tendering strategy that drives genuine business growth.

The fundamental shift required isn't just about learning to write better bids - it's about transforming your entire approach to business development. Successful tendering companies don't just respond to opportunities; they position themselves strategically, build relationships proactively, and create systematic processes that consistently win work. This comprehensive approach to growth through tendering has helped hundreds of businesses break through their growth ceiling and secure the contracts that transform their operations. At Thornton & Lowe we offer outsourced bid writing and wider marketing and business growth services!

Book a call - hello@thorntonandlowe.com

Understanding the UK Tendering Landscape

The Procurement Act 2023, which comes into full effect in October 2025, is reshaping how tendering works across the UK. The new legislation emphasises transparency, innovation, and social value whilst simplifying processes for both buyers and suppliers. For businesses positioned correctly, these changes create significant advantages over competitors still operating with outdated approaches.

Types of Tendering Opportunities

Understanding the different types of tendering opportunities helps businesses focus their efforts where they're most likely to succeed. Framework agreements represent perhaps the most valuable long-term opportunity – these are essentially approved supplier lists that public sector organisations use for routine purchasing. Once approved onto a framework, suppliers can bid for specific contracts without going through full pre-qualification processes each time. A quick one - PQQs became SQs but are now largely known as PSQ!

Major frameworks like those managed by Crown Commercial Service, YPO, or Fusion21 can provide years of steady work for successful applicants. The Healthcare Framework alone is worth over £10 billion across its lifetime, whilst construction frameworks regularly exceed £1 billion in total value. Understanding framework agreements and their strategic importance is crucial for long-term business growth through tendering.

Direct tender opportunities – where organisations run standalone procurement exercises – offer different advantages. These typically have fewer competitors than frameworks and allow for more tailored proposals that can command premium pricing. Government departments, NHS trusts, local authorities, and major corporations regularly run direct tenders for everything from professional services to complex project delivery.

Market Sectors and Specialisation

Different market sectors offer varying levels of opportunity and complexity. Understanding sector-specific requirements, typical contract values, and procurement characteristics helps businesses target their efforts effectively and prepare appropriate responses.

Sector |

Key Requirements |

Common Contract Values |

Typical Duration |

|---|---|---|---|

Healthcare (NHS) |

Clinical governance, patient safety |

£50K - £10M+ |

2-7 years |

Education |

Safeguarding, educational outcomes |

£25K - £5M+ |

1-4 years |

Local Government |

Social value, transparency |

£30K - £50M+ |

3-8 years |

Central Government |

Security clearance, innovation |

£100K - £100M+ |

2-10 years |

Social value and value for money is key for all of these organisations of course!

The healthcare sector, including NHS trusts and private healthcare providers, spends billions annually on everything from medical supplies to facilities management and IT services. Education represents another major opportunity, with universities, colleges, and local authority education departments regularly procuring services ranging from construction and maintenance to professional development and technology solutions.

Local government tendering covers an enormous range of services – from waste collection and street cleaning to social care and regeneration projects. Housing associations and social landlords represent a growing market, particularly for construction, maintenance, and support services. Central government departments offer high-value opportunities but typically require more sophisticated responses and longer-term relationship building.

Private sector tendering operates differently but offers equally significant opportunities. Utilities companies regularly tender for maintenance, construction, and professional services. Major retailers and manufacturers outsource everything from logistics and facilities management to HR and training services. Financial services companies procure substantial amounts of professional services, technology, and support functions through formal tendering processes.

Book a free consultation today

Click hereThe Business Case for Growth Through Tendering

Financial Benefits and Stability

The financial benefits of successful tendering extend far beyond individual contract values. Public sector contracts typically offer better payment terms than private sector work – public bodies pay within 30 days and some guarantee payment within 10 days. This improved cash flow can transform business operations, particularly for companies used to chasing payment from smaller private sector clients.

Contract values in tendering are typically substantial – it's rare to see public sector tenders worth less than £50,000, and many opportunities are worth hundreds of thousands or millions of pounds. For a business currently winning £20,000-£30,000 projects, landing a single £200,000 tender can represent a step change in operations and capability.

Framework agreements provide particular financial advantages through their multi-year nature. A typical framework runs for four to 8 years now, providing revenue opportunities that allow business directors make confident investment in staff, equipment, and capabilities. This predictability allows businesses to plan growth strategically rather than reactively responding to market fluctuations.

Competitive Advantages

Businesses that excel at tendering often find they develop competitive advantages that extend beyond the tender market. The rigorous documentation and process requirements of public sector work force companies to systematise their operations, improve their quality management, and develop robust project management capabilities. These improvements benefit all areas of the business, not just tendered work.

The case study evidence required for tender responses drives businesses to document their successes more thoroughly, creating marketing assets that prove valuable in all sales situations. The compliance requirements – health and safety policies, environmental management, quality assurance procedures - raise overall business standards and often open doors to private sector opportunities that have similar requirements.

Professional development within tendering companies typically accelerates as staff gain exposure to larger, more complex projects. The skills developed in managing major public sector contracts - stakeholder management, project delivery, compliance management are highly transferable and increase the business's overall capability.

Breaking Through Growth Barriers

Many successful businesses reach a point where their traditional growth methods plateau. Referrals and repeat business provide steady income but limited expansion opportunities. Marketing generates leads but often for smaller projects that don't justify the investment in business development. Tendering offers a structured route to larger opportunities that can fundamentally shift the business's trajectory.

The chicken and egg challenge that prevents many businesses from accessing larger contracts is real but not insurmountable. The key lies in understanding that procurement teams don't just look at contract size when assessing experience – they evaluate relevance, complexity, and outcomes. A £50,000 project that demonstrates innovation, stakeholder management, and measurable results can provide compelling evidence for a £200,000 tender if presented correctly.

Strategic positioning before pursuing large opportunities makes the difference between success and frustration. This involves developing the right policies and procedures, creating professional case studies, building relevant partnerships, and establishing thought leadership in target sectors. This preparation phase, whilst requiring investment, pays dividends when the right opportunities arise.

Framework Opportunities: The Foundation of Tendering Success?

Understanding Framework Agreements

Framework agreements represent the most systematic approach to accessing large-scale tendering opportunities, yet they're often misunderstood by businesses new to the market. A framework is essentially a pre-approved supplier list that buying organisations use to streamline their procurement processes. Rather than running full tender exercises for routine purchases, they can select suppliers from the framework and either award contracts directly or run mini-competitions between framework members.

The value proposition for suppliers is compelling: once approved onto a framework, the pre-qualification burden disappears for future opportunities. Instead of repeatedly proving financial stability, technical competence, and compliance credentials, suppliers can focus on demonstrating their solution and value proposition. This dramatically reduces the cost and time investment required for each bid whilst increasing win rates through reduced competition.

Framework agreements typically run for four years with options to extend for up to eight years total. This longevity provides suppliers with sustained access to opportunities and enables them to build relationships with buying organisations over time. The most successful framework suppliers don't just wait for opportunities to arise – they proactively engage with framework users to understand their needs and position themselves for upcoming requirements.

Major Framework Providers

Crown Commercial Service (CCS) operates the largest and most valuable frameworks in the UK, managing agreements worth tens of billions of pounds annually. Their frameworks cover everything from professional services and technology to construction and facilities management. Becoming a CCS supplier requires sophisticated preparation and specialist CCS framework writing expertise, but the scale and reach make them attractive despite intense competition.

Regional framework providers like YPO, Fusion21, and NEPO offer different advantages, often with strong relationships to specific geographic areas or sector focuses. YPO, for example, has particularly strong connections to education and local government in Yorkshire and beyond. These regional frameworks often receive fewer applications than national equivalents, creating better odds for well-prepared suppliers whilst still providing access to substantial opportunities.

Sector-specific frameworks operated by buying consortiums or individual large organisations can provide excellent opportunities for specialist suppliers. NHS frameworks for medical equipment or pharmaceuticals, education frameworks for specialist services, or local authority frameworks for specific functions often attract suppliers with deep sector knowledge and established relationships.

Framework Application Strategy

Successful framework applications require a fundamentally different approach from direct tender responses. Where direct tenders focus on specific project requirements, framework applications must demonstrate capability across the full scope of potential work that might arise over several years. This requires broader evidence, more diverse case studies, and deeper demonstration of organisational capability.

The timing of framework applications is crucial but often overlooked. Major frameworks typically receive hundreds or thousands of applications, creating intense competition. However, this competition is often uneven – many applicants submit poor-quality responses that fail to meet basic requirements, whilst others target inappropriate frameworks where they have little chance of success.

Research and preparation separate successful applicants from the crowd. Understanding the current framework users, the types of work typically awarded, the values and volumes involved, and the key selection criteria enables suppliers to tailor their applications precisely. This intelligence gathering takes time but dramatically improves success rates whilst helping businesses target the most suitable opportunities.

Maximising Framework Success

Getting onto a framework is just the beginning – the real value comes from winning individual contracts through the framework. Many suppliers make the mistake of assuming that framework approval automatically generates work, leading to disappointment when opportunities don't materialise. Successful framework suppliers treat approval as a marketing qualification rather than a sales outcome.

Proactive engagement with framework users distinguishes successful suppliers from passive ones. This involves regular communication with procurement teams, attendance at supplier events, and systematic relationship building with key decision makers. Understanding each organisation's procurement pipeline, budget cycles, and strategic priorities enables suppliers to position themselves effectively for upcoming opportunities.

Framework performance monitoring and reporting requirements provide valuable intelligence about user organisations whilst demonstrating supplier capability. Rather than treating these as administrative burdens, successful suppliers use performance data to showcase their value and identify opportunities for service improvement or expansion. Framework services that support both application success and ongoing maximisation deliver the greatest long-term value.

Service Component |

Purpose |

Key Activities |

Business Impact |

|---|---|---|---|

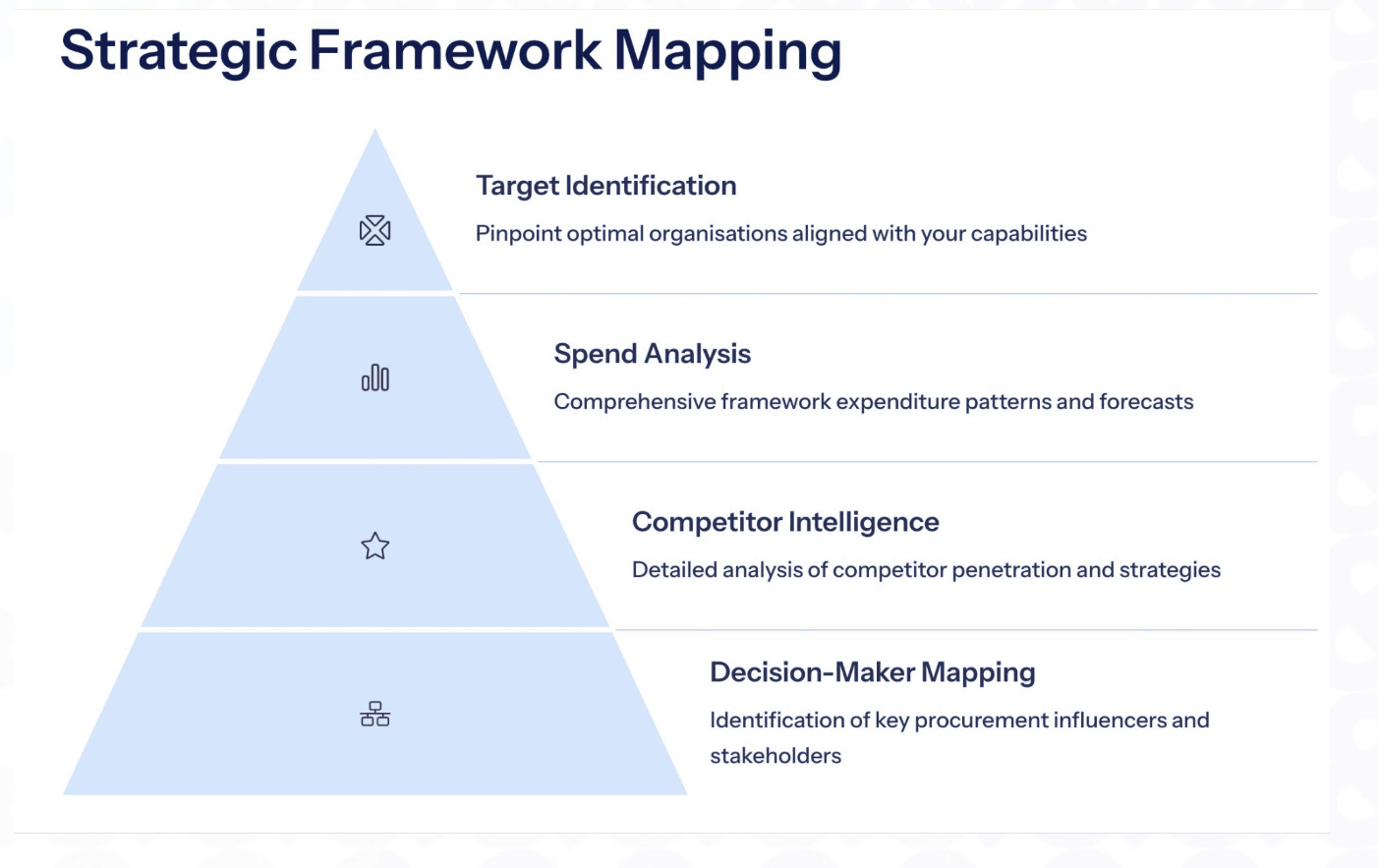

Target Identification |

Pinpoint optimal organisations aligned with capabilities |

Market mapping, spend analysis, capability matching |

Focus resources on highest-probability opportunities |

Spend Analysis |

Understand framework expenditure patterns and forecasts |

Historical data review, budget cycle analysis, pipeline mapping |

Predict when and where opportunities will arise |

Competitor Intelligence |

Analyse competitor penetration and strategies |

Market positioning assessment, win/loss analysis |

Identify gaps and competitive advantages |

Decision-Maker Mapping |

Identify key procurement influencers and stakeholders |

Stakeholder analysis, relationship mapping, engagement planning |

Build relationships before opportunities arise |

Direct Tender Opportunities: Winning Standalone Contracts

Identifying High-Value Opportunities

Direct tender opportunities require a different approach from framework applications, focusing on specific project requirements rather than broad capability demonstration. These opportunities often offer higher margins than framework work because competition is typically more limited and buyers are looking for tailored solutions rather than commodity services.

The key to success with direct tenders lies in early identification and thorough preparation. By the time a tender is formally published, the buying organisation has typically been planning the procurement for months or even years. Suppliers who engage during this planning phase can influence the specification and requirements, creating significant competitive advantages.

Market intelligence gathering for direct opportunities involves monitoring procurement pipelines, tracking spending patterns, and building relationships with key stakeholders before formal procurement begins. This proactive approach enables suppliers to understand the real requirements behind formal specifications and position their capabilities accordingly.

Sector-Specific Opportunities

Different sectors offer varying levels of direct tender opportunity, each with distinct characteristics and requirements. Healthcare procurement, whether NHS trusts or private providers, typically involves complex stakeholder management and rigorous compliance requirements. Education tenders often emphasise innovation and measurable outcomes whilst requiring competitive pricing.

Local government tenders frequently include social value requirements and community benefit considerations alongside technical specifications. Understanding these broader evaluation criteria enables suppliers to develop compelling propositions that go beyond basic service delivery. Private sector tenders may be less formally structured but often involve more sophisticated commercial negotiations and risk allocation.

Central government tenders represent some of the highest-value opportunities but typically require substantial resources to pursue effectively. The complexity of government requirements, combined with intense scrutiny and formal processes, means that preparation and expertise are essential for success.

Competitive Positioning

Direct tenders often attract fewer bidders than framework opportunities, but the competition is typically more sophisticated. Success depends on understanding both the formal requirements and the underlying business challenges driving the procurement. This intelligence enables suppliers to craft responses that address real needs rather than just meeting specification requirements.

Differentiation in direct tenders comes through demonstrating unique value propositions, innovative approaches, or superior outcomes rather than just compliance with requirements. The most successful bid responses tell compelling stories about how the supplier will solve the buyer's problems and deliver measurable benefits.

Pricing strategy for direct tenders requires careful consideration of the total cost of ownership rather than just initial contract value. Buyers increasingly focus on long-term value and whole-life costs, creating opportunities for suppliers who can demonstrate efficiency improvements, risk reduction, or innovation benefits. Developing the right pricing strategy and understanding competitor pricing approaches enables more informed commercial positioning.

Bid Mentor Service?

See detailsBuilding Your Tender-Ready Business Foundation

Essential Policies and Procedures

Before pursuing significant tendering opportunities, businesses must establish the policies and procedures that demonstrate professional capability and compliance readiness. This foundation work often determines success or failure before a single word of the tender response is written. Procurement teams use these requirements to filter out unprepared suppliers early in the evaluation process.

Health and safety policies form the cornerstone of tender readiness for most opportunities. Public sector buyers require evidence of robust safety management systems, including written policies, training records, incident reporting procedures, and regular review processes. The specific requirements vary by sector - construction tenders demand comprehensive RAMS (Risk Assessment and Method Statements), whilst office-based services focus more on workplace safety and duty of care obligations.

Quality management systems provide another critical foundation element. Many tenders require ISO 9001 certification or equivalent quality management systems. However, certification alone isn't sufficient – buyers want evidence of how quality systems translate into consistent service delivery and continuous improvement. This requires documented processes, performance monitoring, and examples of quality improvements driven by systematic review.

Financial Strength and Stability

Financial stability requirements in tendering can exclude otherwise capable suppliers who haven't prepared adequately. Most significant opportunities require evidence of financial health through audited accounts, credit ratings, and specific financial ratios. The exact requirements vary, but buyers typically want to see turnover, profitability, and cash flow sufficient to deliver the contract without financial stress.

Turnover requirements often specify minimum levels relative to contract value - commonly requiring annual turnover of 1.5 to 3 times the annual contract value. For businesses seeking to win larger contracts than their historical norm, this can create a barrier that requires creative solutions. Joint ventures, parent company guarantees, or partnership arrangements can sometimes address turnover shortfalls, but these solutions require careful structuring and early preparation.

Professional indemnity insurance and public liability coverage represent non-negotiable requirements for most professional services tenders. The required coverage levels often exceed what smaller businesses carry for their existing operations. Understanding typical requirements early enables businesses to adjust their insurance arrangements before pursuing larger opportunities.

Case Studies and Evidence Development

Compelling case studies form the backbone of successful tender responses, yet many businesses struggle to present their experience effectively. The key lies in understanding that procurement teams aren't just interested in what you've done – they want to understand how you work, what challenges you've overcome, and what results you've achieved for clients.

Effective case studies follow a structured approach that demonstrates relevance to the opportunity being pursued. The STAR method (Situation, Task, Action, Result) provides a framework for presenting experience clearly and persuasively. Each case study should establish the context and challenges, explain the specific approach taken, and quantify the outcomes achieved.

Evidence goes beyond case studies to include testimonials, performance data, quality certifications, and innovation examples. The most persuasive evidence comes from independent verification – client testimonials, audit reports, performance monitoring data, and third-party certifications. This external validation carries more weight than internal claims and helps build confidence in your capabilities.

Team Capability and Resources

Tendering success increasingly depends on demonstrating team capability and resource availability rather than just organisational credentials. Buyers want confidence that the people who will deliver the work have the skills, experience, and availability to succeed. This requires detailed information about key personnel, their qualifications, and their track record on similar projects.

CV presentation for tendering differs significantly from recruitment CVs, focusing on relevant project experience, technical qualifications, and measurable achievements rather than career progression. The most effective approach involves creating project-specific CVs that highlight experience directly relevant to the opportunity whilst demonstrating depth and breadth of capability.

Resource planning and project management capability have become critical evaluation criteria as buyers focus more on delivery risk. Evidence of robust project management processes, resource planning systems, and backup arrangements for key personnel helps address buyer concerns about delivery capability and business continuity.

The Strategic Approach to Bid Writing

Understanding Buyer Requirements

Successful bid writing begins long before pen touches paper or fingers hit keyboard. The foundation of any winning response lies in thoroughly understanding what the buyer actually needs, as opposed to what they've written in the specification. This distinction often determines the difference between compliant responses that meet basic requirements and compelling responses that win contracts.

Reading between the lines of tender documents requires skill and experience. Procurement teams often inherit specifications from operational colleagues who understand their needs but may not translate them effectively into procurement language. The published specification represents their best attempt to capture requirements, but the underlying business challenges and desired outcomes often provide more valuable insight for crafting winning responses.

Stakeholder mapping within buying organisations helps identify the real decision makers and influencers beyond the formal procurement team. Technical specialists, budget holders, end users, and senior management all play roles in the evaluation process, each with different priorities and concerns. Understanding these varied perspectives enables bid writers to address multiple audiences within a single response.

Structuring Compelling Responses

The structure of a tender response significantly affects how evaluators receive and score the content. Procurement teams often evaluate dozens or hundreds of responses within tight timescales, making clarity and accessibility crucial for success. Responses that are difficult to navigate or understand, regardless of their technical quality, risk receiving lower scores simply because evaluators cannot easily find the relevant information.

Executive summaries at the beginning of responses or individual sections provide evaluators with clear roadmaps to the detailed content that follows. These summaries should highlight key differentiators, address potential concerns, and guide readers to the most compelling evidence. The best executive summaries work as standalone documents that could secure a positive evaluation even if the detailed content wasn't read.

Question-by-question responses require careful attention to both explicit requirements and scoring methodologies. Understanding how marks are allocated enables bid writers to focus effort where it will have maximum impact. A question worth 20% of the total score deserves proportionally more attention than one worth 5%, yet many responses treat all questions equally. Effective bid strategy development and comprehensive bid writing guidance help ensure responses are properly structured and weighted.

Evidence-Based Persuasion

Modern procurement emphasises evidence-based decision making, requiring bid responses to go beyond claims and assertions to provide proof of capability and performance. This shift reflects buyers' increasing sophistication and their need to justify decisions to stakeholders, auditors, and the public. Responses that fail to provide adequate evidence simply cannot score highly regardless of their other merits.

Quantified benefits and outcomes carry more weight than general statements about quality or capability. Rather than claiming to "improve efficiency," successful responses specify "reducing processing time by 25% and cutting error rates from 3% to less than 1%." These specific, measurable claims enable evaluators to understand the scale of benefits and compare different suppliers objectively.

Third-party validation through client testimonials, independent assessments, or audit reports provides crucial credibility for claimed capabilities and outcomes. Buyers understand that suppliers will present themselves in the best possible light, making independent confirmation of claims particularly valuable. The most persuasive testimonials address specific aspects of service delivery that align with the buyer's stated priorities and concerns.

Pricing Strategy and Commercial Positioning

Pricing in competitive tendering requires balancing multiple factors: winning the immediate opportunity, maintaining profitability, and positioning for long-term relationships. The lowest price doesn't always win, but unrealistic pricing rarely succeeds either. Understanding the evaluation methodology and weighting between price and quality enables suppliers to make informed decisions about their commercial positioning.

Value-for-money assessments increasingly replace simple lowest-price evaluations, particularly in public sector procurement. This shift creates opportunities for suppliers who can demonstrate superior outcomes, reduced risks, or innovation benefits that justify higher prices. However, the value proposition must be clearly articulated and supported by evidence to influence evaluators.

Whole-life cost considerations enable sophisticated suppliers to position premium pricing within compelling commercial arguments. By demonstrating lower operating costs, reduced maintenance requirements, or superior durability, suppliers can justify higher initial prices through total cost of ownership benefits. This approach requires detailed analysis and clear presentation but can create sustainable competitive advantages.

Sector-Specific Tendering Strategies

Healthcare and NHS Opportunities

Healthcare tendering represents one of the UK's largest and most complex procurement markets, with the NHS alone spending over £30 billion annually through competitive processes. Success in this sector requires understanding both the technical requirements of healthcare delivery and the unique pressures facing healthcare organisations today.

NHS procurement operates under intense scrutiny from regulators, patient groups, and the media, making compliance and quality assurance particularly critical. Suppliers must demonstrate not just technical capability but also understanding of patient safety requirements, clinical governance, and regulatory compliance. Evidence requirements often exceed those in other sectors, reflecting the high-stakes nature of healthcare delivery.

Innovation and outcome improvement opportunities are increasingly valued in healthcare procurement as organisations seek to address growing demand within constrained budgets. Suppliers who can demonstrate measurable improvements in patient outcomes, staff efficiency, or cost effectiveness often secure premium pricing and long-term partnerships. However, these claims must be supported by robust evidence and clear measurement methodologies.

Private healthcare providers offer different opportunities with potentially faster decision-making processes and more commercial flexibility. However, the same quality and safety requirements apply, and many private providers follow NHS procurement principles to ensure professional standards and risk management.

Education Sector Opportunities

Education procurement spans schools, colleges, universities, and local education authorities, each with distinct characteristics and requirements. Primary and secondary education procurement often focuses on value for money and measurable educational outcomes, whilst higher education tends towards more sophisticated procurement with emphasis on innovation and research collaboration.

Local authority education procurement typically involves larger contracts with standardised requirements across multiple schools or institutions. These opportunities often include social value requirements and local economic development considerations alongside technical specifications. Understanding these broader policy objectives enables suppliers to develop more compelling propositions.

University procurement often involves more complex stakeholder management with academic, administrative, and student representatives all playing roles in evaluation processes. Research collaboration opportunities and knowledge transfer potential can provide significant differentiators for suppliers with relevant capabilities.

Term-time constraints affect education procurement cycles, with most major procurements planned around academic years and many requiring implementation during holiday periods. Understanding these timing constraints helps suppliers plan their resources and implementation approaches effectively.

Local Government and Public Services

Local authority procurement covers an enormous range of services from traditional functions like waste collection and highway maintenance to social care, economic development, and digital transformation. Each service area has distinct characteristics, but all operate under similar transparency and accountability requirements.

Social value requirements have become central to local government procurement following the Public Services (Social Value) Act 2012. Suppliers must demonstrate how their delivery will benefit local communities through employment opportunities, skills development, environmental improvements, or support for local businesses. These requirements often carry significant scoring weight and require detailed planning and evidence.

Budget constraints and political oversight create unique pressures in local government procurement. Suppliers must demonstrate not just service quality but also clear value for money and transparent cost structures. The ability to deliver services within tight budget constraints whilst maintaining quality standards often determines procurement success.

Community engagement and stakeholder management capabilities are increasingly valued as local authorities seek to improve public satisfaction and demonstrate democratic accountability. Suppliers who can evidently engage effectively with diverse community groups and handle public scrutiny often secure competitive advantages.

Private Sector Corporate Opportunities

Private sector tendering operates with different dynamics from public procurement, often involving faster decision-making, more flexible processes, and greater emphasis on commercial innovation. However, many large corporations now adopt procurement practices similar to public sector approaches, creating familiar processes for experienced suppliers.

Relationship-building plays a more significant role in private sector success, with procurement decisions often influenced by broader commercial relationships and strategic partnerships. Understanding corporate priorities, market pressures, and competitive challenges enables suppliers to position their offerings within broader business contexts.

Innovation and competitive advantage opportunities are often more readily embraced in private sector procurement, creating scope for premium pricing and differentiated service delivery. However, commercial confidentiality requirements and competitive sensitivities can limit the evidence-sharing that supports public sector responses.

Risk allocation and commercial terms typically receive more attention in private sector procurement, with sophisticated negotiation processes and detailed contract terms. Suppliers need robust commercial and legal capabilities to compete effectively whilst protecting their own business interests.

Book a free Business Growth consultation

Click hereDeveloping Your Internal Capabilities

Building a Bid Team

Creating an effective internal bid capability requires more than just designating someone to "handle tenders." Successful tendering demands specific skills, dedicated time, and systematic processes that complement rather than compete with existing business development activities. The most successful businesses treat bid management as a professional discipline requiring investment and development. Take a look at Bid Resource - our dedicated recruitment agency for all roles bid, tender and proposal....

The core skills required for effective bid management span writing and communication, project management, research and analysis, and commercial awareness. Few individuals possess all these skills naturally, making team-based approaches more effective than relying on single individuals. Even smaller businesses benefit from involving multiple people in bid development, bringing diverse perspectives and expertise to strengthen responses.

Time allocation for bid development often surprises businesses new to tendering. A significant tender response might require 40-80 hours of professional time to develop properly, whilst framework applications can demand substantially more. Understanding these time requirements enables businesses to plan resources effectively and avoid last-minute rushes that compromise quality.

Training and development needs for bid teams differ from general sales or marketing training. Bid writing requires understanding of procurement processes, evaluation methodologies, and compliance requirements alongside communication skills. Professional bid and tender training helps teams stay current with changing regulations and best practices whilst improving their effectiveness over time.

Quality Assurance and Review Processes

Quality assurance in bid development goes beyond proofreading and formatting to encompass compliance checking, evidence verification, and strategic review. The consequences of errors or omissions in tender responses can be severe – from automatic disqualification for late submission to poor scores for inadequate evidence – making systematic quality assurance essential.

Multiple review stages help ensure responses meet all requirements whilst presenting the business effectively. Initial compliance reviews check that all questions are answered, word limits are observed, and mandatory documents are included. Content reviews assess whether responses adequately address the requirements and scoring criteria. Final reviews focus on presentation, clarity, and overall persuasiveness.

Independent review by people not involved in response development often identifies issues that authors miss through familiarity with the content. External perspectives help ensure responses are accessible to evaluators who may not have detailed knowledge of the supplier's business or sector expertise.

Review timescales must be built into bid development programmes from the outset rather than treated as final-stage activities. Adequate time for review and revision often determines the difference between good responses and winning responses, making this planning crucial for success.

Technology and Process Systems

Modern tendering increasingly involves electronic submission systems, online portals, and digital document management. Businesses pursuing tendering opportunities must invest in appropriate technology infrastructure and ensure their teams are comfortable with these systems. Late submissions due to technical difficulties are rarely accepted regardless of the circumstances.

Document management systems help bid teams organise evidence, track version control, and maintain libraries of standard content for reuse across multiple responses. These systems become particularly valuable as bid activity increases and teams need to manage multiple concurrent opportunities whilst maintaining quality standards.

Customer relationship management (CRM) systems adapted for procurement tracking help businesses monitor opportunities, maintain stakeholder relationships, and analyse win/loss patterns over time. Understanding which types of opportunities generate the highest success rates enables more focused business development efforts.

Performance monitoring and feedback analysis systems help businesses learn from both successful and unsuccessful bids. Many procurement organisations provide feedback to unsuccessful bidders, offering valuable insights for improving future responses. Systematic capture and analysis of this feedback drives continuous improvement in bid capability.

Working with Professional Bid Writing Services

When to Outsource vs Develop Internally

The decision between developing internal bid capabilities and outsourcing to professional services depends on multiple factors including bid volume, complexity, available resources, and strategic priorities. Many successful businesses use hybrid approaches, combining internal sector knowledge and client relationships with external bid writing expertise and capacity.

Resource constraints often drive initial outsourcing decisions, particularly for businesses pursuing larger opportunities than their historical norm. Professional bid writers bring immediate capability and capacity that would take months or years to develop internally. However, outsourcing works best when combined with internal involvement to ensure responses reflect genuine business capabilities and maintain authentic voice. Professional bid writing services can bridge this gap whilst building internal knowledge over time.

Cost considerations extend beyond immediate fees to include opportunity costs of internal resource allocation. Senior staff time spent on bid development cannot be allocated to client delivery or business development activities. Professional services often prove cost-effective when these broader resource implications are considered alongside direct fees.

Learning and development opportunities from working with professional services can accelerate internal capability building. Observing professional processes, understanding best practices, and receiving training alongside service delivery creates lasting value beyond individual bid responses.

Selecting the Right Partner

Choosing professional bid writing services requires careful evaluation of capabilities, experience, and working approaches. Thornton & Lowe's bid writing services offer comprehensive support from initial opportunity assessment through to submission and follow-up, backed by one of the UK's largest directly employed bid writing teams.

Experience in relevant sectors provides crucial advantages through understanding of typical requirements, common evaluation criteria, and effective response strategies. However, process expertise and writing capabilities often transfer across sectors more readily than deep technical knowledge, making the balance between sector experience and professional competence important to consider.

Service models vary from complete bid outsourcing through collaborative partnerships to advisory and review services. The most effective approach depends on internal capabilities, available time, and the specific requirements of each opportunity. Flexible service providers who can adapt their approach to client needs often deliver better outcomes than rigid service models.

Success rates and references provide important indicators of service quality, but these should be evaluated in context of the types of opportunities pursued and client characteristics. A 75% success rate on suitable opportunities with proper preparation is more impressive than higher rates achieved through cherry-picking easy wins or working only with already-successful clients. Client testimonials from successful partnerships provide valuable insights into service quality and approach.

Maximising Value from Professional Services

Effective collaboration with professional bid writers requires clear communication about business capabilities, market positioning, and strategic objectives. The most successful partnerships involve clients who provide comprehensive briefings, available evidence, and ongoing support throughout the response development process.

Knowledge transfer during the bid development process helps clients understand best practices, improve their internal processes, and develop capabilities for future opportunities. Professional services that include training and development elements often provide greater long-term value than pure service delivery models.

Performance monitoring and feedback analysis in partnership with professional services helps identify patterns in success and failure whilst developing strategies for continuous improvement. Understanding which approaches work best for specific types of opportunities enables more targeted future efforts.

Long-term partnerships with professional services can provide strategic advantages through deeper understanding of client capabilities, market positioning, and growth objectives. Retainer-based relationships often prove more cost-effective than project-by-project arrangements whilst providing greater consistency and responsiveness.

Ready to transform your business growth through strategic tendering? Our expert team has helped hundreds of businesses break through the chicken and egg challenge to secure the contracts that drive sustainable growth. Contact us today on 01204 238 046 or email hello@thorntonandlowe.com to discuss how we can accelerate your tendering success.

Technology Solutions for Tender Management

Tender Pipeline and Opportunity Identification

Systematic opportunity identification separates successful tendering businesses from those that reactively respond to whatever opportunities they happen to discover. Professional tender monitoring services track thousands of new opportunities daily across all sectors and regions, enabling businesses to identify suitable opportunities early in the procurement cycle.

Advanced filtering and alert systems help businesses focus on opportunities that match their capabilities, capacity, and strategic objectives. Rather than reviewing every opportunity manually, smart systems can automatically identify high-potential opportunities based on contract value, sector, location, and keyword criteria. Professional bid management software enables businesses to focus their research efforts on the most promising opportunities through systematic tracking and analysis.

Early identification creates real advantages for bid development, enabling suppliers to research buying organisations, understand stakeholder requirements, and potentially influence specification development before formal procurement begins. The most successful tendering businesses identify opportunities months before they are formally advertised, creating substantial competitive advantages.

Pipeline management, like Tender Pipeline, help businesses plan their resources and capacity around upcoming opportunities whilst maintaining balanced portfolios of different opportunity types, timescales, and risk levels. Understanding when opportunities are likely to arise enables better resource allocation and reduces the feast-or-famine cycles that affect many tendering businesses.

Bid Management and Tender Library

Professional bid management requires systematic organisation of evidence, templates, policies, and previous responses. Digital libraries enable bid teams to quickly locate relevant content whilst ensuring version control and quality standards. The time saved through effective document management often determines whether businesses can respond to opportunities within tight timescales. Tender Library does this!

Our 'starter pack' of tenders answers for common question types enable faster response development whilst maintaining consistency and quality. However, templates must be carefully adapted for each opportunity rather than used as generic responses. The most effective template systems provide structure and guidance whilst enabling customisation for specific requirements.

Performance Analysis and Continuous Improvement

Win/loss analysis provides crucial insights for improving tendering performance over time. Understanding which factors contribute to success or failure enables businesses to refine their targeting, improve their responses, and develop more effective strategies. However, this analysis requires systematic data capture and objective evaluation rather than anecdotal assessment.

Feedback capture and analysis from unsuccessful bids helps identify specific areas for improvement whilst building intelligence about buyer preferences and evaluation approaches. Many buyers provide detailed feedback to unsuccessful bidders, creating valuable learning opportunities for those who systematically capture and analyse this information.

Benchmarking against industry success rates helps businesses understand their relative performance whilst identifying opportunities for improvement. However, success rates must be evaluated in context of opportunity types, competition levels, and preparation quality rather than simple numerical comparisons.

Continuous improvement processes that incorporate lessons learned, market intelligence, and feedback analysis help businesses develop increasingly effective tendering approaches over time. The most successful tendering businesses treat each opportunity as a learning experience whilst systematically implementing improvements.

Book a demo

Click hereMeasuring Success and ROI in Tendering

Key Performance Indicators

Measuring tendering success requires tracking multiple metrics beyond simple win rates, though success rates remain an important indicator of overall performance. Leading businesses typically achieve win rates of 25-40% on suitable opportunities with proper preparation, though this varies significantly by sector, competition levels, and opportunity types.

Bid-to-revenue ratios help assess the efficiency of tendering investment by comparing the cost of bid development with the value of contracts won. Successful businesses often invest 1-3% of potential contract value in bid development, though this can vary significantly based on opportunity size, complexity, and competition levels.

Pipeline value and conversion rates provide insights into business development effectiveness beyond individual bid outcomes. Understanding how many opportunities must be identified to generate sufficient pipeline for growth targets helps businesses plan their business development resources and activities.

Time-to-revenue metrics help assess the overall efficiency of the tendering process from opportunity identification through contract mobilisation. Longer sales cycles require different resource planning and cash flow management compared to traditional business development approaches. Understanding these timescales enables more accurate business planning and resource allocation.

Average contract values and profit margins provide insights into the quality of opportunities being pursued and won. Successful tendering businesses often achieve higher average contract values and margins compared to their traditional sales channels, reflecting the premium pricing opportunities available through formal procurement processes.

Return on Investment Analysis

Calculating ROI for tendering activities requires considering both direct costs and opportunity costs of resource allocation, but the timeframes and returns vary significantly based on the sector, nature of the client, their development stage, and how professional support is engaged. This variation is crucial to understand when planning tendering investments.

Direct costs include bid development time, external support services, travel expenses, and any specialist software or training investments. However, the opportunity cost of senior staff time often represents the largest investment component.

The reality of tendering ROI is more nuanced than simple long-term projections. Whilst building a comprehensive tendering capability takes time, many businesses see immediate returns through targeted interventions. Training delegates regularly report applying techniques learned in our workshops to secure quick wins on current opportunities. A light-touch bid review service, often requested just weeks before submission deadlines, frequently delivers immediate improvements visible in procurement feedback and success rates.

Quick wins often come from identifying missed opportunities - frameworks and tenders that clients hadn't discovered, or maximising existing framework and DPS positions that weren't being used effectively as sales tools. These interventions can generate results within days or weeks rather than months, providing immediate validation of the investment whilst building towards longer-term capability.

Our balanced approach recognises that whilst tendering for major contracts involves extended timescales, professional support can deliver quick returns through improved processes, missed opportunity identification, and better utilisation of existing positions. This combination of immediate improvements and long-term capability building ensures positive ROI regardless of where businesses start their tendering journey.

Long-term value creation through tendering often exceeds immediate contract wins through improved business processes, enhanced capabilities, and stronger market positioning. Many businesses find that tendering disciplines improve their overall operational standards and create competitive advantages that benefit all aspects of their operations.