Flexible procurement that works for buyers and SMEs

Public procurement has more flexibility than before. The safeguards remain the same. We still need to be open, transparent and accountable. The difference is that buyers now have more options in how they plan competitions and manage delivery, and suppliers have better chances to show modern, value for money solutions. This article sets out a practical, two sided approach that brings buyers and SMEs together around outcomes, not process.

What flexible and fair looks like in practice

Flexibility is not a shortcut. It is the freedom to choose the right route to market, design sensible evaluation, and make proportionate changes during delivery. It works when buyers talk to the market early and keep contract management simple, and when suppliers bring evidence, not slogans. The aim is the same on both sides. Better results for residents and clear value for money.

Book a free consultation

Click hereFor housing associations and public bodies: when to run PME and how to do it well

Run Preliminary Market Engagement when the decision you are about to make will have real impact on residents, compliance or cost. That usually includes larger housing maintenance and repairs, voids, compliance services, grounds and estate services, waste, ICT platforms that touch customer services, and any local initiative where the outcome is visible to tenants or stakeholders.

Treat Preliminary Market Engagement as strategy work, not a formality.

A simple eight week PME plan

Week 1: define the problem in plain English. Write down outcomes, constraints, must have standards, budget envelope, and what good looks like for residents and staff.

Week 2: publish a short market summary and a question set. Invite written responses and set times for supplier sessions.

Weeks 3 to 4: hold supplier sessions. Keep a common agenda. Ask all suppliers the same core questions. Record what you learn.

Week 5: compare models. In house, single supplier, regional or thematic lots, alliance style, or a place on frameworks with a call off plan. Stress test payment flows and mobilisation.

Week 6: decide your route to market and evaluation model. If SME access matters, design lots and proportionate entry requirements.

Weeks 7 to 8: draft the tender notice and documents. Keep questions tightly linked to outcomes and contract measures. Publish a clear timetable.

Questions that get useful answers

- What would you change in the service model to lift first time fix rates and reduce avoidable visits

- How would you stage mobilisation inside eight weeks and protect business as usual

- What data do you need from us to prove performance and value for money each month

- Which risks will you take and which risks you need us to own to keep price stable

- What is the smallest sensible lot size that still gives us resilience and coverage

Turn learning into a route to market

If local outcomes or speed matter, consider a short direct competition under existing frameworks that already screen standards and insurance. If innovation or collaboration matter, consider a dynamic market or a multi lot approach that welcomes new entrants during the life of the agreement. Record why you chose that route and how it supports value for money and fair access.

For small businesses that want to win more public contracts

You will not win on promises. You will win on proof, clarity and fit.

Three moves that have the most impact in the next ninety days

Positioning: pick three service lines where you can evidence outcomes buyers care about, for example first time fix, void turnaround, complaints reduction, or carbon and energy savings. Build one page case notes with numbers, contactable references, and how you managed risk. Use them in PME and bids.

Route readiness: know the live and upcoming frameworks in your space. Decide where you lead, where you partner, and where you form a consortium. Prepare the paperwork once, then reuse it. Keep insurance, policies and accreditations current and proportionate to the work you actually deliver.

Bid quality: remove fluff. Answer the question, show the method, show the numbers, and show the team. Back it with service levels, payment discipline for your subcontractors, and how you will report monthly without burden. If you need help turning delivery know how into clear, scored answers, our bid writing services will do that with you.

How to use PME well as an SME

Register early, attend, and send short written answers on time. Bring options at two budget points and explain trade offs. Show how you would lot the work to widen competition. Offer a clean mobilisation plan and the first month’s reporting pack so buyers can see it will work. Keep it short and practical.

Contract management is where value is delivered

You only see the benefit of a good competition if the contract is managed well. Keep it simple and consistent.

A clear rhythm that works

Mobilisation: agree baselines, measures, and data owners before go live. Build a short risk log that names owners on both sides.

Monthly: share numbers that matter. Output, outcome, cost and risk. Close actions quickly and record decisions.

Quarterly: review trends, agree small improvements, and run a light market sense check where it helps.

Always: pay on time and check payment flows through the chain. Good suppliers stay solvent and focused. Poor cash flow destroys performance.

When change is needed, use change control early. Keep the scope change small, explain the reason, and record the effect on price and risk. If the change is more than a tweak, consider whether a fresh competition will give you better value.

Using frameworks and dynamic markets well

For buyers, frameworks are a fast way to reach screened suppliers. They work best when you run a focused mini competition with a clear specification and a scoring model that rewards the outcomes you learned in PME. If you need ongoing competition and new entrants, set up a dynamic market and keep the join and re join process simple.

For SMEs, understand how each framework you target actually buys. Some call off by region or theme. Some use direct award on price or quality. Some require a mini competition every time. Tailor your offer and evidence to the real call off method and be ready to move quickly.

Social value that helps the contract, not just the score

Tie social value to the work. On housing services, focus on local jobs, apprenticeships in trades you actually use, and small improvements that lift resident satisfaction. Measure and report in the same dashboard as operational KPIs so it stays real.

Accessibility and fairness

Buyers should keep documents readable and requirements proportionate. Short, clear questions with page limits and plain English favour both fairness and better answers. SMEs should keep answers tight, avoid jargon, and explain how you will comply with standards and reporting without passing cost back to the buyer.

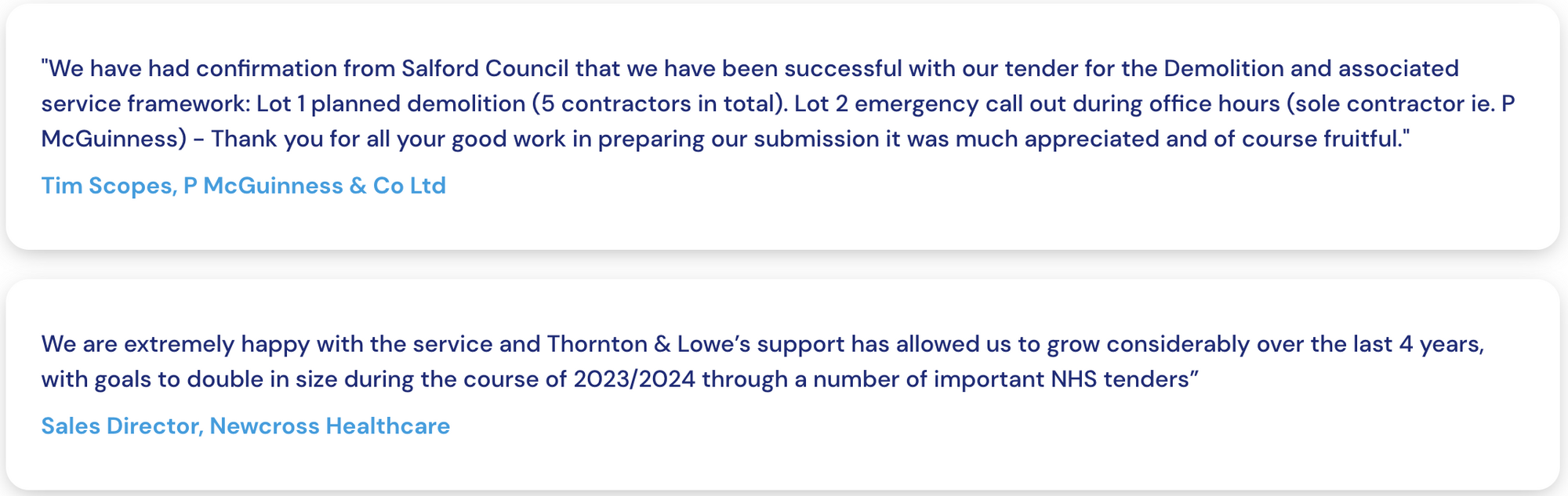

How Thornton & Lowe helps both sides

For buyers, we deliver outsourced procurement consultancy services for housing associations, local government and charities. That includes PME planning and delivery, route to market, tender drafting, evaluation support, and contract management and administration. We set up simple processes that your teams can run.

For suppliers, we help you turn delivery knowledge into clear, scored bids. We shape strategy, improve positioning on the right frameworks, and provide hands on bid writing services so your answers are specific, compliant and easy to assess.

If you want help on a live project, contact us for a free consultation. Getting the strategy right is key.

Phone: 01204 238046

Email: hello@thorntonandlowe.com

Appendix: example PME agenda you can copy

Opening: purpose, outcomes, scope, constraints, and what good looks like for residents.

Delivery models: how would you structure the service for resilience and first time fix

Implementation: how you would mobilise and protect business as usual

Data: measures you will report monthly and who owns the data

Value: where you can reduce waste, avoid duplication and simplify the customer journey

Risk: key delivery risks, who should own them, and what controls you need

Market access: lot sizes or dynamic market entry that would widen competition without losing control

Use this agenda across all supplier sessions. Share the same materials and timings. Publish a short summary of what you learned and how it shaped your route to market.