Payment Solutions 3 Framework: £15bn Opportunity for Payment Card Providers - Complete Guide

Crown Commercial Service Announces Major New Payment Solutions Framework

Crown Commercial Service (CCS) has published the Prior Information Notice for its new Payment Solutions 3 framework (RM6383), valued at an estimated £15 billion over four years. This significant procurement opportunity will provide central government and wider public sector organisations with payment cards for business purchases and fund disbursement solutions. It's therefore a great opportunity for those involved in the sector!

The new framework, which will replace the current RM6248 Payment Solutions 2 agreement, is expected to be published as a contract notice on 4 February 2026, with a planned go-live date of 1 October 2026. CCS is now inviting potential suppliers to express interest in upcoming market engagement sessions scheduled for March 2025.

What is Crown Commercial Service and the Payment Solutions Framework?

Crown Commercial Service is the UK's largest public procurement organisation, managing over £18 billion of public spending annually. CCS works with both central government departments and wider public sector organisations to ensure they achieve maximum commercial value when procuring common goods and services.

The Payment Solutions framework is CCS's specialised agreement that provides public sector organisations with access to payment cards, prepaid cards, and voucher solutions. These services allow government bodies to streamline purchasing processes and disburse funds efficiently, helping to reduce administrative burdens while maintaining appropriate controls and providing detailed management information.

Framework Structure: Three Specialised Lots

The new framework will be divided into three lots, each focused on a specific type of payment solution:

Lot 1: Procurement Cards: This lot will provide physical, virtual, and lodged card solutions for purchasing common goods and services, including travel arrangements. "Lodged" cards allow organisations to establish accounts with frequently-used suppliers without requiring employees to carry physical cards. This lot will likely be the highest value, as it covers regular purchasing activity across the public sector.

Lot 2: Prepaid Cards: This lot will offer prepaid card solutions as an alternative to cash payments. These cards can be used to disburse funds to individuals who may not have access to traditional banking services, while maintaining controls on where and how the funds can be spent.

Lot 3: Vouchers: This lot will provide end-to-end voucher schemes with multiple closed-loop voucher options (also known as gift cards). These are typically used for welfare support, incentive programmes, and other situations where specific types of spend need to be enabled.

The PIN indicates that the framework's total value of £15 billion is primarily reflective of the spending that will flow through these payment solutions rather than the fees for providing the services themselves.

Current Market Players Looking at Requalifying

The existing Payment Solutions 2 framework includes twelve suppliers across its lots. Many of these established providers will likely be preparing to bid for the new framework to maintain their public sector business:

Major banks with current framework positions include Barclays Bank PLC, HSBC Bank PLC, Lloyds Bank PLC, and National Westminster Bank Public Limited Company. These institutions primarily provide procurement card solutions under the current framework.

Specialised payment providers on the current framework include Allpay Limited, Prepaid Financial Services Limited, and Soldo Software Ltd, offering various types of payment solutions including prepaid cards.

The voucher solution marketplace includes providers such as Blackhawk Network EMEA Limited, Evouchers, Huggg Limited, Pluxee UK Ltd, and Reward Gateway (UK) Ltd.

These incumbents bring significant experience in serving public sector clients, but the new framework also presents an opportunity for new entrants to gain access to this substantial market.

Time-Sensitive: Key Actions to Take Now

With the publication date set for February 2026, and market engagement scheduled for March 2025, there are several actions potential bidders should take soon:

First, express interest in the market engagement sessions by emailing paysols@crowncommercial.gov.uk before midday on 3 February 2025. These sessions will provide valuable insights into CCS's specific requirements and priorities for the new framework.

Second, begin your Cyber Essentials Plus certification process if not already certified. The PIN explicitly states this is a mandatory requirement for bidding. The certification process typically takes 6-12 weeks and often requires technical adjustments to systems, so starting this process early is essential.

Third, develop your Carbon Reduction Plan in line with PPN 06/21 requirements. This requires specific content and formats, including baseline emissions data and clear reduction targets. Based on our experience with other frameworks, developing a compliant plan typically takes 4-6 weeks, including data collection, analysis, and formal documentation.

Fourth, review your current public sector performance data if you're an incumbent provider. Begin collecting evidence of successful implementations, transaction volumes, reliability metrics, and customer satisfaction data that will support your bid responses.

Fifth, ensure you have a valid DUNS number for registration on the CCS eSourcing system. The PIN specifically notes this requirement, and obtaining a new DUNS number can take several weeks if you don't already have one.

Key Changes and Improvements in the New Framework

While the full specification will only be released with the tender documents, the PIN and supporting information highlight several important aspects of the new framework:

Extended Term: The new framework will run for a full four years from October 2026 to October 2030, providing longer-term stability for both buyers and suppliers compared to the current framework's 3+1 structure.

Enhanced Spend Controls: Lots 1 and 2 will allow customers to control spending by setting monthly or single transaction limits using merchant category groups (MCG) and merchant category codes (MCC), ensuring appropriate oversight of public expenditure.

Annual Rebates: Lot 1 customers will benefit from annual rebates based on spend, paid retrospectively, creating additional value for high-volume users.

Support for Prompt Payment: The framework will support government prompt payment policies, with Lot 1 suppliers guaranteed payment within 3 working days, helping to maintain cash flow efficiency.

Increased Compliance Requirements: Suppliers will need to meet more stringent compliance requirements, including Cyber Essentials Plus certification and carbon reduction plans in line with Procurement Policy Note 06/21.

Important Compliance Requirements for Suppliers: The PIN highlights several mandatory compliance requirements that will be essential for successful bidders:

Cyber Essentials Plus Certification: Unlike the previous framework where alternative accreditations were temporarily accepted, the PIN explicitly states that bidders "will be required to demonstrate that they are Cyber Essentials Plus certified for the services under and in connection with the procurement." This higher-level certification requires technical verification through tests of the organisation's systems.

Carbon Reduction Plan: In line with PPN 06/21, suppliers will need to provide a compliant Carbon Reduction Plan. This requirement reflects the government's commitment to net zero carbon emissions and will be a mandatory element of the tender.

Security Classification Handling: The services will involve handling material classified as OFFICIAL/SENSITIVE under the Government Security Classifications Scheme. Suppliers will need to implement solutions in accordance with specific security requirements that will be detailed at the ITT stage.

Data Protection and Privacy: Given the financial nature of these services and the personal data involved, suppliers will need to demonstrate robust data protection measures compliant with UK GDPR and other relevant legislation.

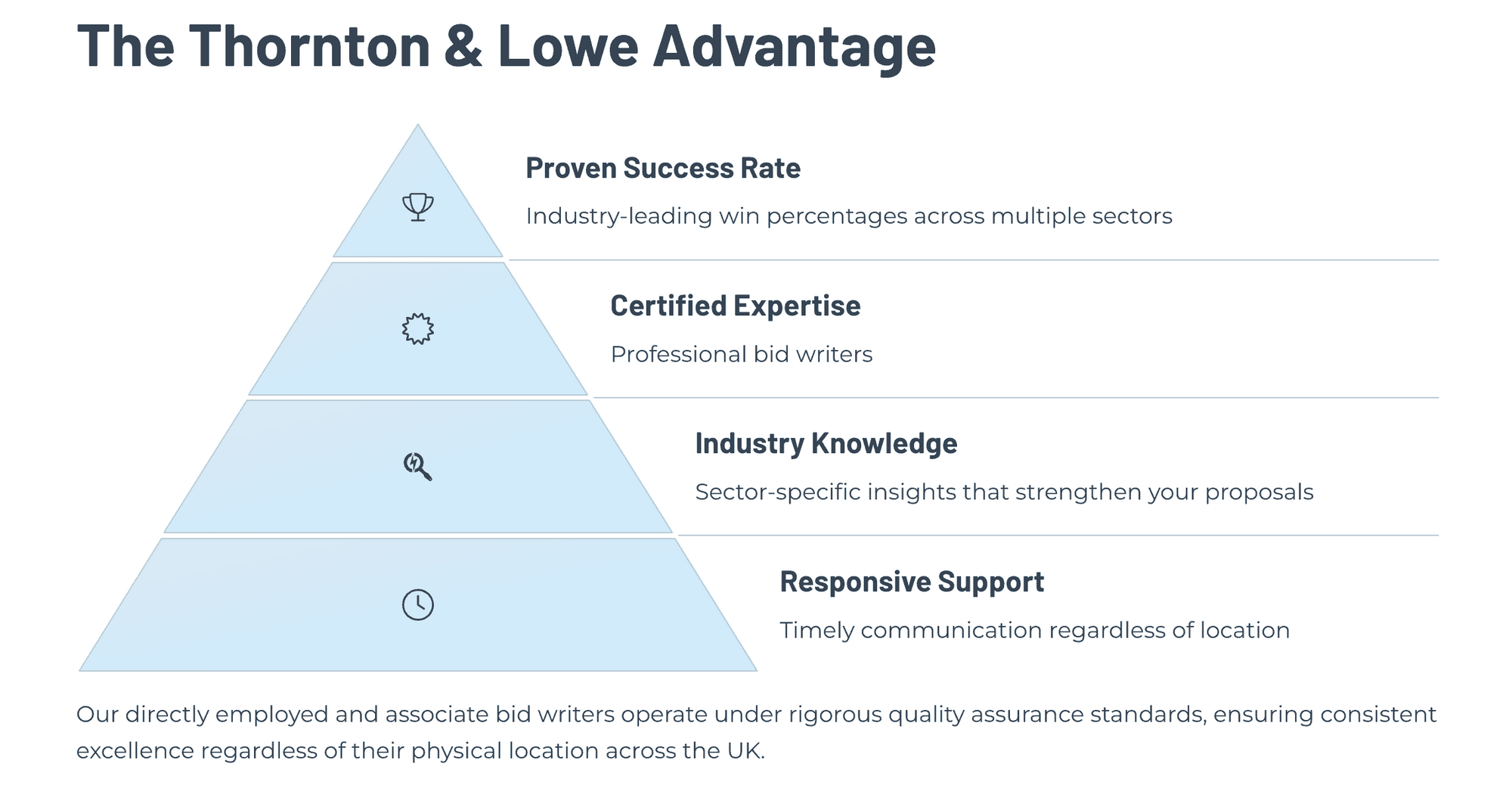

Thornton & Lowe's Framework Bid Support: Practical Help

At Thornton & Lowe, we help businesses win places on important government frameworks such as Payment Solutions 3. Our support goes beyond general bid writing to offer practical, tailored guidance:

Strategic Positioning - we start by carefully matching your services to the specific lot requirements. For Payment Solutions 3, this means clearly aligning your payment products with the needs of public sector buyers and determining the most suitable lots for your business.

Our experts will help you clearly demonstrate your strengths to public sector evaluators. For payment services, we typically highlight security, reliability, control features, and strong reporting capabilities that reassure public sector buyers about governance and accountability.

We have worked with CCS to help them improve their tendering documents to be more accessible for SMEs. In addition to this, we have helped public sector procurement evaluate tenders, including training buyers on evaluating social value responses!

Compliance Checks - we carry out thorough checks to identify any gaps in your compliance with framework standards. For Payment Solutions 3, this includes evaluating your Cyber Essentials Plus certification, carbon reduction measures, security practices, and data protection policies.

We then provide clear, practical steps to close any gaps identified. If you need Cyber Essentials Plus certification, for instance, we explain the certification process clearly, outline typical timelines (usually around 6-12 weeks), and highlight common technical challenges to avoid delays.

Response Writing - our experienced bid writers develop clear, evidence-driven responses tailored specifically to CCS framework evaluations. We understand CCS evaluators prefer straightforward, structured responses with specific examples and measurable benefits.

For financial services frameworks like Payment Solutions 3, we clearly illustrate your technical abilities in ways evaluators appreciate. Instead of just listing product features, we show how these features provide practical advantages to public sector buyers, such as greater control, less admin workload, improved fraud prevention, and better reporting.

Book a free consultation

Contact us todayStrategic Considerations for Potential Bidders

The payment solutions market is evolving rapidly, and several strategic factors should inform your approach to this framework opportunity:

Public Sector Priorities

Public sector organisations are increasingly focused on several key aspects of payment solutions:

- Digital transformation is driving demand for virtual cards and mobile payment integration, reducing reliance on physical cards while maintaining or enhancing control features.

- Management information capabilities are becoming more sophisticated, with buyers expecting detailed real-time reporting, integration with finance systems, and advanced analytics to support spending optimisation.

- Fraud prevention features are a top priority, particularly as remote working has changed purchasing patterns and potentially introduced new risks.

- Sustainability considerations now extend beyond carbon reduction to include factors such as biodegradable card materials, paperless statements, and environmentally-responsible production processes.

Competitive Landscape

The payment solutions market includes both traditional financial institutions and newer fintech providers, creating a diverse competitive landscape:

- Established banks bring institutional credibility and extensive infrastructure but may be less agile in adapting to changing requirements.

- Specialised payment providers often offer more innovative features and greater flexibility but may need to demonstrate their scale and security capabilities.

- For voucher solutions, providers with the broadest merchant networks typically have an advantage, but specialised solutions for particular sectors (such as food or utilities) can also be highly valued.

- Multi-lot bidders may have advantages in offering integrated solutions across procurement cards, prepaid cards, and vouchers, but specialised providers can compete effectively by demonstrating superior capabilities within their niche.