CWAS3 Construction Works and Associated Services 3 Framework Opportunity: Not to Be Missed

The Crown Commercial Service (CCS) is developing a new Construction Works and Associated Services 3 (CWAS3) framework that will reshape public sector construction procurement. This is a key opportunity that construction firms simply cannot afford to miss, as it will combine three existing CCS frameworks into one comprehensive solution.

A consolidation of major frameworks

CWAS3 will replace three current frameworks:

- RM6088 Construction Works and Associated Services

- RM6267 Construction Works and Associated Services 2 (CWAS2) / ProCure 23 (P23)

- RM6184 Offsite Construction Solutions

With a planned launch in autumn 2026 and the tender process starting in winter 2025, this consolidation creates a significant opportunity for suppliers to access billions in public sector construction spend through a single framework route.

Where things stand

CCS has been busy gathering feedback from buyers and suppliers. They've held webinars in January and March 2025, with more formal market engagement planned from May 2025 onwards.

Key points worth noting

Recent webinars and Q&A sessions have been taking place - below we've highlighted a few key points to be aware of:

The indexation issue is being addressed. CCS admits the CPI indexation approach used in CWAS2 caused market appetite problems and confirmed they're "looking again at this" with variations expected. This could make a real difference to project viability.

Contract forms will stick to what works. CCS plans to use "off the shelf and unamended standard construction contracts" like NEC, JCT, PPC and SBCC, with government boilerplate terms added. Clients can then include specific clauses for their project needs.

The framework will be closed despite some concerns. CCS has decided a closed framework better supports "long term relationships between clients and suppliers." This makes securing a position on the framework even more valuable.

Pricing approaches are under review. Currently CWAS uses OHP percentages with common labour charge rates, while OCS operates on a £per msq rate plus OHP. Both approaches are being reconsidered for CWAS3.

Framework structure taking shape

The potential structure shows three distinct areas emerging:

Construction Works and Services

- Regional and value-banded lots with adjusted inflation values

- Separation of general building from civil engineering work

- Specialist sector lots covering Defence, Nuclear, Overseas and Residential

Manufactured Solutions

- Value-banded lots for both 3D Volumetric and 2D Panelised solutions

- Hire lot options being explored

- Specialist sector lots for Defence, Health and Justice

ProCure24

- NHS England has a commitment to over £7bn worth of active projects

- Regional and value-banded lots specifically for healthcare construction

An interesting innovation being considered is an "Early Integrator" lot, which would bring contractors into projects during planning and feasibility stages.

What's interesting about the current market engagement

CCS has received 141 responses to their initial survey - 66 from existing suppliers (18% SMEs) and 75 from potential new suppliers (55% SMEs). This suggests new SMEs see real opportunity in the framework.

The regional coverage data is particularly telling. The East Midlands shows the strongest supplier representation at 60% (with 20% being SMEs), while Northern Ireland has just 23% coverage (11% SMEs). These gaps could present opportunities for firms with regional strengths.

Customer engagement has mainly been through strategic forums with Central Government (44%) and Local Authorities (19%). For sector specialisms, Commercial & Retail and Education lead supplier capabilities, while minor works, demolition and nuclear top customer priorities.

Interest levels are high

The engagement appetite for CWAS3 is remarkably strong with 86% of SME suppliers, 79% of larger suppliers and 78% of customers saying they're likely to use the framework.

Market priorities revealed in CCS data

The numbers tell an interesting story about what matters most:

For suppliers, their top priorities are:

- Direct Award procedure

- Lot structure

- CCS/Client collaboration

- Framework pricing

- Further competition procedure

For buyers, speed and quality lead the way:

- Speed of procurement options/route to market

- Pre-assured suppliers (Quality)

- Reduced risk of procurement non-compliance

- Pre-assured suppliers (Financially)

- Procurement flexibility

The biggest headaches for suppliers are:

- Pipeline visibility

- Early Contractor Involvement

- Tender documents & quality criteria

- Sustainability and policy targets

- Specification

While buyers struggle most with:

- Cost & funding constraints

- Engagement in tendering

- Sustainability targets

- Embedding social value

- Procurement/commercial capacity

How Thornton & Lowe can help

Winning a place on CCS Construction Works and Associated Services framework 3 (CWAS3) represents a major opportunity for construction businesses. It's 3 frameworks combined and with some of the benefits of the new Procurement Act!

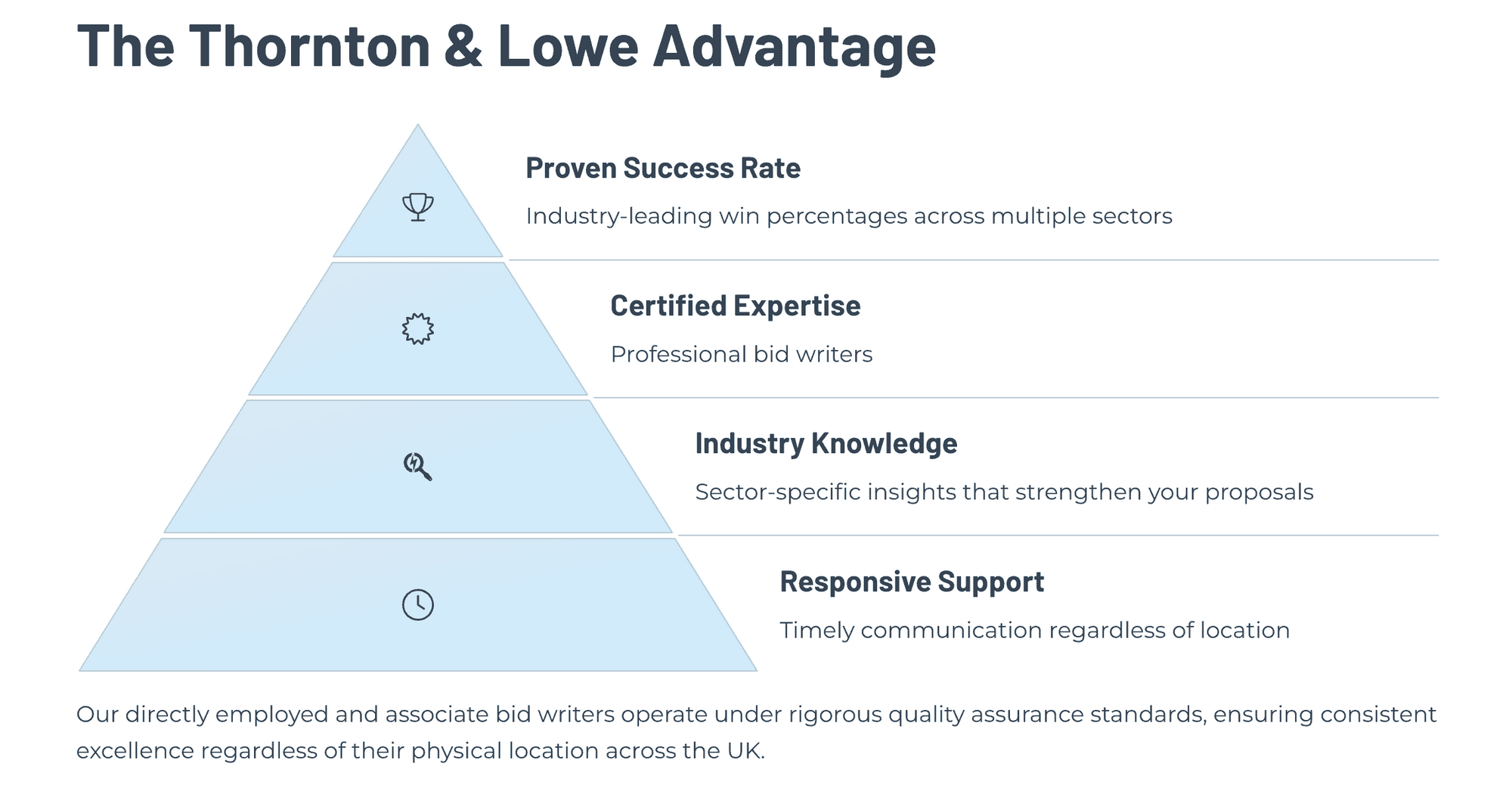

Thornton & Lowe offers specialist support throughout the entire process, from early preparation right through to making the most of the framework once you've secured a place. Our experienced team can help you understand these specific requirements, build a compelling case for inclusion, manage your submission to ensure full compliance with the evolving criteria, and provide guidance on turning your framework position into a genuine revenue source.

With preparations beginning well before the tender, our framework specialists will work alongside you to identify gaps in your approach, develop the evidence needed for a successful bid across the specific lot structures being developed, and ultimately maximise your return on investment from the framework position you secure.

Thornton & Lowe Construction Experience

Construction works and professional services are a key area of strength for Thornton & Lowe. We have delivered tailored bid writing courses, provided bid writing services and framework compliance to organisations large and small. We have successfully work on the previous 3 frameworks, as well as many more CCS frameworks! In addition to this we have also successfully helped our clients win places on construction frameworks with Fusion21, LHC, Pagabo, NWCH and NWUPC. See more examples below.

As well as our core SME clients, we've supported and trained the likes of:

- Balfour Beatty

- BAM Construction

- Kier

- Novus

- Eric Wright Construction

- Anglian Group

Our training sessions are interactive, practical, and designed around the specific needs of each organisation. For example, Jodie Boast, Bid & Proposals Coordinator at Eric Wright Construction, said:

“Charles provided some bid training at our company for the bid team and directors. I thought the training was fantastic. It flowed well, and Charles kept it interactive and informative. It really helped the team understand the bid processes that sometimes can be missed. Charles explained the importance of bidding and showed us how some vital things that can be overlooked can lead to the winning bid. Friendly and approachable - a great session!”

"I would like to take the time thank you and your team for all the support with the Tender Bid. You have some talented people working for you and they are credit to your business." - Martin Tweddle, General Manager, DSD Construction

We also partner with the National Federation of Builders to provide bid writing courses, support and tender writing to their members.

Construction Client Wins - Examples

Our clients have achieved success in construction, infrastructure, and utilities bids for organisations including Transport for Greater Manchester, North West Construction Hub, Peak District National Park, NHS SBS, ESPO, Fusion21, Crown Commercial Service (CCS), central government buyers such as HMRC, as well as numerous local authorities including Manchester City Council, Birmingham City Council, Sunderland Council, Lancashire County Council, and housing associations such as Bolton at Home, Your Housing Group, Together Housing Group, and utilities companies such as United Utilities, Northumbrian Water, Thames Water, Yorkshire Water, and Severn Trent Water.

Book a free consultation today

Click here